Economical Management What exactly are the commonest transfer pricing disputes and how can you avoid them?

Although this guide is just not tax guidance, it should really prepare you for What to anticipate when it comes to taxes and treasured metals.

All purchases also arrive with a Certificate of Authenticity from our Assayer confirming weights and purity as suitable for expenditure functions.

Purchasing gold mining or real Bodily gold is never way too late. So Never overlook out on this golden possibility!

Having said that, It can be crucial to abide by selected policies to avoid IRS scrutiny. First of all, the gold should be pure, like Gold Mexican Onza coins or Maple leaf gold. Next, You should not lend income to oneself or any dependents from these accounts. Be vigilant about these procedures and consult a fiscal advisor if necessary. This tactic, if executed effectively, permits you to sell gold without incurring capital gains tax, rendering it a savvy process for gold transactions. Advisable by LinkedIn

Also, gold has long been in the bull market for a long time now, so It truly is a good choice for your personal extensive-phrase funds. In case you are looking at 401k to gold rollover as an alternative, our Contend manual can assist you make the very best conclusion in your personal predicament.

Settlement is usually pretty fast, with payment by means of secured EFT lender transfer on your nominated account within 24-forty eight hours of physical receipt. For interstate sellers, we deal with insured shipping expenses this means you don’t confront any out of pocket bills.

With Each individual state necessitating unique gross sales tax based on the items requested, APMEX encourages you to employ our interactive map before buying so you know just what exactly you may be billed with your invest in.

When it will come time and energy to money out gold holdings in Australia, One of the more inconvenience-absolutely free solutions is selling straight to a gold bullion supplier. Trustworthy dealers are quickly able to get all common 999.nine pure gold bullion coin and bar products and solutions with no dimensions minimum.

You might have realized how to convert a 401(k) to gold without penalty and so are Prepared for Gold IRA investing.

Your marginal tax fee may differ by province and is determined by the website amount other income you’ve earned.

Your gold custodian will help you throughout the process, and you will be able to purchase gold coins as well as other important metals.

So, how can you being a tax-paying treasured metals proprietor avoid paying out a lot more than you'll want to in profits tax on your steel purchases? The straightforward response is retail outlet your metals overseas or in one of many 41 states that do not presently charge product sales tax.

Make use of a 1031 Exchange Usually, you are able to noticeably lessen your capital gains taxes on treasured metals like gold and silver by using a technique generally known as a 1031 Trade. This entails reinvesting the proceeds from your gold sale into buying extra gold, enabling you to postpone your tax Invoice. The IRS has specific demands for this Trade: The gold you buy need to be of a like-variety for the one you offered.

Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Andrea Barber Then & Now!

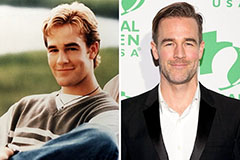

Andrea Barber Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!